Building for a

Better Tomorrow

ESG Strategy

KingSett believes in building value through actively managing ESG risks and opportunities associated with the ownership, development and management of real estate across each asset’s entire lifecycle.

Our ESG approach focuses on doing what is right for our stakeholders and the environment. We are driven by the opportunities and innovation ESG integration presents in real estate. We believe our ESG leadership is a competitive advantage and value creator.

By incorporating ESG into our decision-making processes we create value economically, ethically, socially and environmentally. This strategy outlines and communicates our commitment to acquire, develop and manage our assets responsibly and aligns with our Mission, Vision and Core Values.

We are committed to

investing in sustainable, innovative solutions that enhance communities, mitigate risk and reduce our environmental impact

Stakeholder Engagement

We aim to build relationships with all our stakeholders. Doing so ensures we fulfill our commitments and create shared value through our business activities.

KingSett’s stakeholder engagement activities ensure relationships are built and upheld with respect, integrity, transparency and honesty. Ongoing communication and working collaboratively towards mutually beneficial outcomes are key components in achieving this.

Our engagement programs, at the corporate and property level, are used to generate ideas, solicit feedback, identify best practices and determine the impact of our efforts. Receiving feedback in different forms and from our various stakeholder groups helps ensure our programs are designed to meet the needs of our communities and enhance the performance of our assets.

Our stakeholders include:

- Employees

- Tenants

- Property Managers

- Partners and Investors

- Communities

- Industry Associations

- Customers

KingSett Engages Stakeholders in a Variety of Ways:

Regular Updates

Our Management Committee and CREIF Advisory Board receive quarterly ESG updates that include Portfolio case studies, progress and highlights on ESG issues and trends

Employee Development

Our talent managers and social committee members initiate a variety of new and ongoing social and employee development programs throughout the year

Dashboards

Property and asset managers review asset-specific sustainability dashboards prior to and during budget planning

Surveys

We survey our tenants and employees to help guide our efforts to increase satisfaction, communication and well-being

Targets

CREIF Investors and other stakeholders receive regular updates on progress towards achieving our targets

Social Media

Social media posts highlight key corporate and asset achievements across all portfolios

Thought Leadership

We continuously engage within our government and industry, sharing best practices, new ideas and thought leadership

Engagement

Our property teams engage with asset managers, tenants and communities in their day-to-day functions and hold tenant and community events throughout the year

Reporting

Our annual ESG Report and website provide an in-depth review on ESG throughout the organization and holds us accountable for the commitments we make

Industry Participation

We participate in a number of industry and community associations as members and board of directors to share best practices, ideas and guidance

Materiality

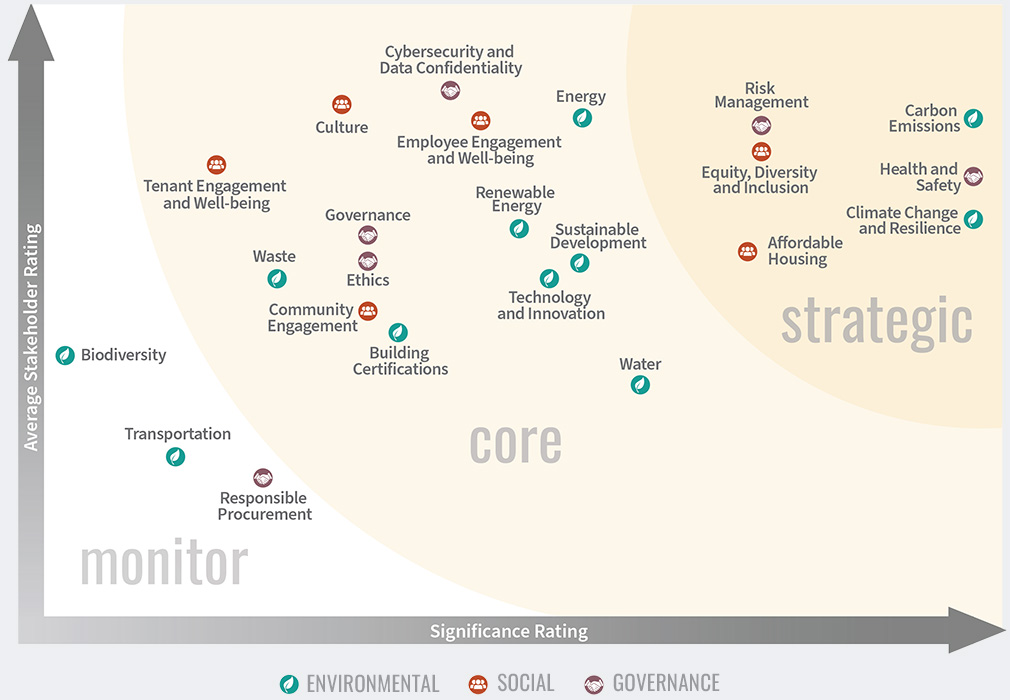

In 2020, KingSett conducted extensive internal and external consultations to understand which ESG topics matter most to our stakeholders and confirm that our ESG efforts are aligned with our partners, customers and employees. The learnings from this exercise continue to shape our ESG approach and objectives:

- Stakeholder feedback confirms KingSett is seen as an ESG leader

- Our stakeholders are proud to partner with us and are eager to work together to meet our shared ESG objectives

- While all 23 ESG topics identified were deemed important, the 20 topics identified as strategic and core form the basis of our program

We will continue to focus on new and emerging trends to unlock value and improve the resilience of our assets and we will re-evaluate our materiality assessment by 2025.

Case Study

UN Principles for Responsible Investment

The Principles for Responsible Investment (PRI) is the most widely adopted ESG integration standard that enables asset owners and managers to publicly demonstrate a commitment to responsible investment and contribute towards building a more sustainable financial system.

In 2022, KingSett became a PRI Signatory. By doing so, we committed to integrating the six Principles of the standard across our business functions. Throughout 2022 we introduced new policies and ESG procedures in our lending business to enhance the quality of our investments and better assess new risks and opportunities as they arise in the market.

Reporting Strategy

Our reporting strategy is the primary way that KingSett informs key stakeholders about our ESG approach, performance and progress. It is designed to meet the various needs of our stakeholders.

2022 ESG Summary Report: An evolution of our annual ESG reporting, KingSett’s ESG Summary provides a high level overview of our key accomplishments and performance from the year and demonstrates how ESG builds value through actively managing the ESG risks and opportunities associated with the ownership, development and management of real estate.

This Website: KingSett Capital’s Environmental, Social and Governance (ESG) approach and the performance of the KingSett Canadian Real Estate Income Fund LP (CREIF) (“Portfolio”) during the 2022 calendar year (January 1, 2022 – December 31, 2022), unless otherwise stated.

2022 Verification Statement: KingSett received limited verification of selected environmental data, including carbon emissions performance disclosed in this report by an independent third party, Quinn+Partners, in accordance with ISO 14064-3. Click to download the 2022 Verification Statement