Investing

in a

Brighter

Tomorrow

Sustainable Investing Strategy

KingSett is committed to enhancing the value of its investments by actively managing the environmental and social risks and opportunities associated with owning, developing and managing real estate throughout each asset's ownership lifecycle.

Our strategy is centred on delivering strong returns and positive impact on our environment and the communities in which we operate. We are motivated by the significant opportunities that integrating sustainable investing and climate resilience into real estate offers. Our approach has a proven track record for generating profitability and creating long-term value.

By integrating sustainability considerations into our decision-making processes, we generate economic, ethical, social and environmental value. Our process articulates and reinforces our dedication to acquiring, developing, and managing assets responsibly, in line with our Values.

We are investing in our properties with the goal to improve their environmental and economic performance, reduce their carbon footprints and meet the needs of our stakeholders. These commitments help build resilience and create sustainable value across our portfolios.

Core Objectives

EMBED sustainability and responsible investing considerations into our business processes

SET reduction targets and execute decarbonization strategies

MEET our sustainable development and social impact guidelines and objectives

IDENTIFY, assess and manage the physical and transition climate risks and opportunities

DRIVE positive social change across our assets and the surrounding communities

LEVERAGE a multi-disciplinary Sustainability Committee to guide the evolution of our strategy

Our

Funds

CREIF

Since 2014, we have integrated sustainability considerations into our CREIF portfolio, which holds core, long-term real estate investments. With this view, we identify sustainability risks and opportunities, set decarbonization targets, implement operational upgrades and report on our progress.

We proactively assess both physical and transitional climate risks and opportunities across the portfolio. We identify key risk areas and focus on addressing them through strategic asset renewal and decarbonization. This approach supports the long-term security of our investments while promoting sustainable growth.

As KingSett’s Sustainable Investing Strategy has evolved in CREIF, we have begun to expand our approach to capture more aspects of our business, including our Mortgage, Affordable Housing and Growth Funds. This expansion will take into account each fund’s mandate and seek to drive economic, environmental and social value for their corresponding stakeholders.

Unless otherwise stated, all performance data, metrics and targets presented in the remainder of this report pertain to our CREIF portfolio only.

Sustainability Achievements

- 2.3M sf achieved Zero Carbon Building – Performance certification

- Secured $47M from Canada Infrastructure Bank to debarbonize 4.8M sf of commercial real estate across Canada

Affordable Housing

KingSett’s Affordable Housing Fund was created in response to Canada’s affordable housing crisis, with a focus on fostering vibrant communities, and driving scalable economic outcomes. The fund aims to generate stable, risk-adjusted returns while providing high-quality, affordable housing to those in need throughout Canada’s rental markets. It encompasses joint ventures, ground-up developments, financing initiatives, and other structures.

Within this fund’s mandate, success has been achieved through integrating net-zero design measures. This includes the reduction of embodied carbon emissions, adoption of geothermal systems, centralized heat pump plants, state-of-the-art building automation systems, and more. Such measures enhance resource efficiency of our new affordable housing developments, building in cost predictability for the future and providing value for decades after construction.

Sustainable Achievements

- Commenced construction on 384 affordable units, with an additional 277 in the pipeline, in partnership with City of Toronto and Greenwin

- Net-zero design measures at 50 Wilson Heights include on-site geothermal system

- Achieved Zero Carbon Building – Design certification at Valhalla Village Phase 1

Next Steps

STRENGTHEN our partnerships with not-for-profits and community agencies to provide additional supplements to deepen housing affordability

FINALIZE design of Valhalla Phase 2

Mortgage Lending

KingSett creates bespoke financing solutions for a wide range of projects and properties. We offer construction and term financing across all asset classes and currently have more than $5.6 billion of loan commitments across Canada. KingSett's Mortgage team has made a commitment to integrate sustainable investing criteria into their lending processes.

Through their Responsible Investment Committee, sustainability is incorporated into decision-making to create value for our partners and clients, in line with our Core Values. Borrower Sustainability surveys, along with positive and negative screening, are integrated into the process to ensure a thorough assessment of the sustainability-related risks and opportunities of a loan before execution.

Due to the continued expansion of sustainability-related policies, the mortgage lending teams have garnered strong recognition for their market leadership. In 2024 KingSett’s PRI results for the Direct – Fixed Income – Private Debt module improved by 49% (from 61/100 to 91/100) . This significant improvement signals to our stakeholders and the broader market that we are effectively identifying and measuring the risks and opportunities around sustainability and climate change within our lending business.

As part of an increased focus on embedding sustainable practices in its lending business, each loan is given a low, medium or high sustainability and impact rating. High rated loans go above and beyond the regional best practices and implementing measures such as, but not limited to:

- On-site renewable energy

- Geothermal heating and cooling

- Triple glazing windows

- Air-source heat pumps

- Adoption of Passive Hause Standard

- Student housing and/or affordable units

Sustainability Achievements:

- Achieved 15% of loan commitments with a high sustainability rating

- Closed on lending for over 1,000 affordable housing units

Next Steps

EXPAND sustainability considerations in our lending process

INCREASE target of annual loan commitments with a high ESG rating

INCREASE post-funding engagement for loans with a high ESG rating

INTEGRATE climate risk surveys into underwriting across the portfolio

Case Study: Championing Sustainable Impact

2024

Mortgage

ESG

Competition

Each year, KingSett’s Mortgage team participates in an annual Best ESG Deal competition, an internal event where loan originators showcase their most impactful sustainability-driven deals. Colleagues cast their votes to recognize the deal that delivers the greatest environmental, social, and governance impact. This year’s winning project was the construction loan for 307 Sherbourne, an 18-storey multifamily student housing development in Toronto. The project stood out for its strong ESG commitments, including pursuing the Canada Green Building Council’s Zero Carbon Building – Design standard, borrower-led ESG strategies and targets, and a goal to achieve Rick Hansen Foundation accessibility certification.

Growth Funds

KingSett’s Growth Funds are closed-ended and diversified opportunity funds created for institutional investors. The strategy of these funds is to invest in Canadian real estate assets with a focus on event-driven, value creation opportunities. Since 2002, we have launched eight closed-end funds in our growth fund strategy and raised $7 billion in capital. These closed-end growth funds are governed by an investment committee with additional oversight from an advisory board representing all investors.

As KingSett continues to take action on its environmental impacts, we continue to expand utility data coverage to include assets in our Growth Funds. The collection and analysis of this data is the first step to enable us to measure the environmental performance and set meaningful reduction targets, ultimately reducing operating costs and driving value.

In 2024 we expanded utility data coverage across the Growth Funds to 80% of GLA. This increased coverage has helped us better understand our energy and water consumption and carbon emissions in our standing investments, and informs our action plans to achieve our SBTi interim and long-term targets.

80%

Utility data coverage across Growth Funds in 2024

Next Steps

EXPAND utility data coverage to 100% of operating properties under all funds

Materiality

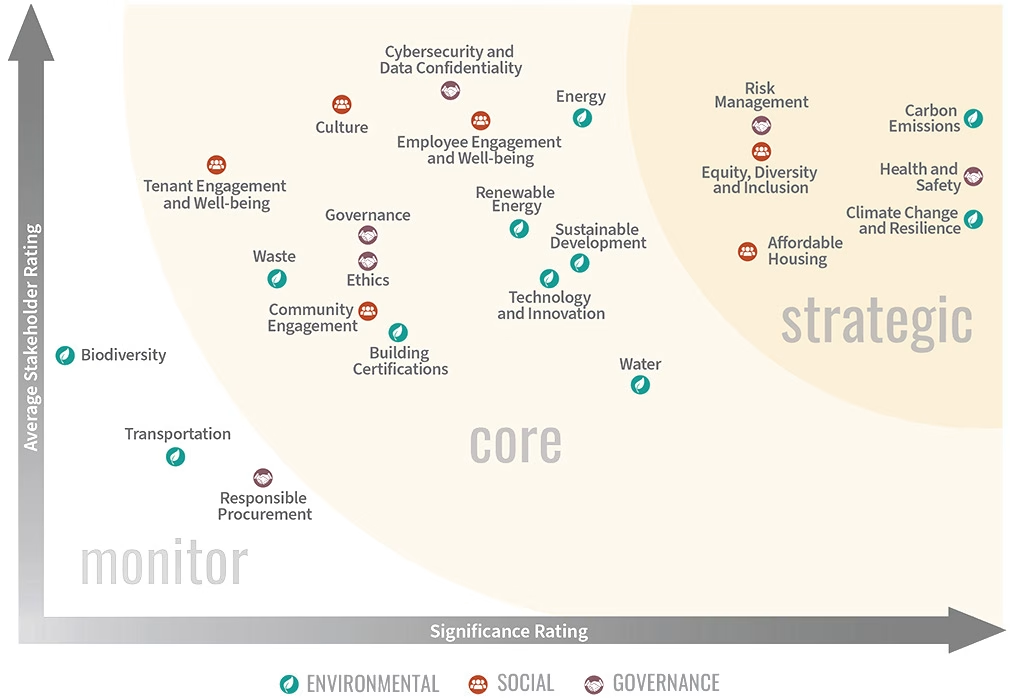

KingSett conducted extensive internal and external consultations to understand which sustainability topics matter most to our stakeholders and confirm that our sustainability efforts are aligned with our partners, customers and employees. The learnings from this exercise continue to shape our sustainability approach and objectives:

- Stakeholder feedback confirms KingSett is seen as a sustainability leader

- Our stakeholders are proud to partner with us and are eager to work together to meet our shared sustainability objectives

- While all 23 sustainability topics identified were deemed important, the 20 topics identified as strategic and core form the basis of our program

We will continue to focus on new and emerging trends to unlock value and improve the resilience of our assets and we will re-evaluate our materiality assessment by 2025.

Sustainable

Development

Goals

Our Sustainable Investment Strategy helps position KingSett to make contributions to the UN Sustainable Development Goals (SDGs) most relevant to our business. Doing so gives us the opportunity to positively impact the broader environments and communities in which we do business and enhance and strengthen our impact wherever possible.

Priority SDG’s for KingSett

| Goals | Our Commitments | 2024 Results | |

|---|---|---|---|

| KingSett is committed to reducing energy use across our assets and helping the industry develop cleaner sources of energy |

|

|

| KingSett strives for equity for all, to make our society and business more successful and work diligently to create a safe and inclusive workplace |

|

|

| KingSett is committed to creating more sustainable, accessible and environmentally friendly buildings and communities for all |

|

|

| KingSett seeks to reduce the material consumption at our assets through the conscientious use of finite resources and minimizing waste generation |

|

|

| KingSett is committed to reducing our carbon emissions and strengthening the resilience of our assets |

|

|

Reporting

Approach

Reporting is the primary way that KingSett informs key stakeholders about our sustainable investing approach, performance and progress. It is designed to meet the information needs of our stakeholders.

2024 Sustainability & Impact Report: KingSett’s Sustainability & Impact Report provides a high-level overview of our key accomplishments and performance from the year and demonstrates how sustainability and resilience builds value through actively managing the risks and opportunities associated with the ownership, development and management of real estate.

This Website: The details of our sustainable investing strategy and performance are communicated through our sustainability website. The performance data, metrics and targets presented on this website relate to the KingSett Canadian Real Estate Income Fund LP (CREIF) (“Portfolio”) during the 2024 calendar year (January 1, 2024 – December 31, 2024), unless otherwise stated. Over time, we plan to expand our performance to include energy and emissions from our mortgages, growth and affordable housing funds.