Responsible Investments

Governance

KingSett’s Board of Directors, Management Committee and Sustainability & Impact Committee are dedicated to strong governance practices that prioritize transparency and accountability and promote integrity and ethics while delivering sustainable premium risk-weighted returns. Our Values inform our decision-making and underpin our approach to governance.

Oversight and accountability of sustainability risks and opportunities associated with the ownership, development and management of real estate across an asset’s lifecycle is a top priority. KingSett’s governance framework ensures representation from all relevant business functions.

We operate as a values-based organization, embedding strong governance practices across the company

Our approach to governance is composed of:

- Oversight of strategy is provided by the Board of Directors

- Potential conflicts of interest are mitigated through a number of independent Advisory Boards

- Engagement of professional firms to provide insight and advice across the business

- Engagement of property management firms and joint venture or third-party partners to operate our properties and execute the strategy

- Independent audits of the financial statements and sustainability metrics

- Incorporating third-party standards such as SASB, TCFD, SBTI and PRI

- Robust internal governance policies and corporate controls

- Regular and transparent investor reporting, including sustainability performance

- Active risk and asset management

- Strong alignment with KingSett principals and employees

Governance of Climate-related Risks and Opportunities

Board of Directors

KingSett’s Board of Directors is responsible for the oversight of KingSett’s strategic plans and priorities. This includes information pertaining to climate-related risks and opportunities, including CREIF’s decarbonization strategy and financing activities. The Board receives quarterly updates from Management on climate-related risks and opportunities and provides final approval for significant strategic decisions, such as capital allocations for decarbonization expenditures. The Board of Directors delegates day-to-day responsibility for all elements of company strategy and operations, including climate-related risks and opportunities, to the Management Committee.

Management Committee

The Management Committee is responsible for and has oversight over all day-to-day operational matters relating to KingSett, including KingSett’s Sustainability program. The Committee is comprised of senior executives, including;

- Chief Executive Officer

- Chief Investment Officer

- Chief Financial Officer

- Chief Capital Officer

- Chief Asset Management Officer

- Chief Legal Officer and President

- Mortgage Operations

The oversight of sustainability and social impact of this committee is facilitated through the Sustainability Committee which is made up of senior members from the Asset Management, Strategic Capital, Mortgages and Finance teams.

Sustainability & Impact Committee

KingSett’s Sustainability & Impact Committee is responsible for championing and executing KingSett’s Sustainability Strategy. The Sustainability & Impact Committee is comprised of representatives from across our core business, with the main objective of ensuring sustainability is embedded into all business functions; making it relevant, compelling and inspiring to internal and external stakeholders. In addition, the Sustainability & Impact Committee:

- Ensures the Strategy aligns with KingSett’s governance standards as outlined in its Governance Framework document

- Ensures that sustainability KPIs, targets and action plans align with and support achievement of KingSett’s Strategy

- Monitors markets, clients, competitors and regulations

- Identifies and shares best practices and business opportunities

Stakeholder

Engagement

We aim to build relationships with all our stakeholders. Doing so ensures we fulfill our commitments and create shared value through our business activities.

KingSett’s stakeholder engagement activities ensure relationships are built and upheld with respect, integrity, transparency and honesty. Ongoing communication and working collaboratively towards mutually beneficial outcomes are key components in achieving this.

Our engagement programs, at the corporate and property level, are used to generate ideas, solicit feedback, identify best practices and determine the impact of our efforts. Receiving feedback in different forms and from our various stakeholder groups helps ensure our programs are designed to meet the needs of our communities and enhance the performance of our assets.

Our stakeholders include:

- Employees

- Tenants

- Property Managers

- Partners and Investors

- Communities

- Industry Associations

- Customers

KingSett engages stakeholders

in a variety of ways

DASHBOARDS: Property and asset managers review asset-specific sustainability dashboards prior to and during budget planning

SOCIAL MEDIA: Social media posts highlight key corporate and asset achievements across all portfolios

REPORTING: Our annual Sustainability & Impact Report and sustainability website provide an in-depth review on sustainability throughout the organization and holds us accountable for the commitments we make

REGULAR UPDATES: Our Management Committee and Advisory Boards receive quarterly sustainability updates that include Portfolio case studies, progress and highlights on sustainability issues and trends. Joint Venture and Fund investor partners recieve quarterly and annual updates on sustainability related issues and trends directly impacting their investments

SURVEYS: We survey our tenants and employees to help guide our efforts to increase satisfaction, communication and well-being

THOUGHT LEADERSHIP: We continuously engage within our government and industry, sharing best practices, new ideas and thought leadership

INDUSTRY PARTICIPATION: We participate in a number of industry and community associations as members and board of directors to share best practices, ideas and guidance

EMPLOYEE DEVELOPMENT: Our talent managers and social committee members initiate a variety of new and ongoing social and employee development programs throughout the year

TARGETS: CREIF Investors and other stakeholders receive regular updates on progress towards achieving our targets

ENGAGEMENT: Our property teams engage with asset managers, tenants and communities in their day-to-day functions and hold tenant and community events throughout the year

Risk

Management

We take an active role in identifying and mitigating risks associated with owning, developing and managing real estate in Canada.

Our process for identifying and assessing risks and opportunities, including sustainability and climate-related risks, is embedded into our day-to-day business operations. We take action to mitigate and monitor risks, particularly those that could significantly affect KingSett’s reputation, financial performance or business operations.

Sustainability risks, in particular climate risks, continue to be a growing concern for investors and stakeholders. We proactively take steps to improve the climate resilience and energy efficiency of our assets and manage the physical and transition risks of climate change.

This includes:

- Collaboration with our stakeholders to ensure alignment and support on priorities

- Participation in industry associations and committees to ensure we are identifying and mitigating risks before they materialize

- Remediation of high-to-extreme risks in capital planning when major systems are due for renewal

- Capitalizing on opportunities within the properties when major work or capital is occurring to address as many risk mitigating opportunities as possible

- Development of asset and fund strategic plans that unlock the most value for our stakeholders while ensuring they will meet long-term resilience needs

- Significant ESG risks are escalated to the Management Committee and evaluated to determine capital allocation to address these risks

Our approach to managing risk at the property-level follows the basic principles of ISO 14001.

Plan

We establish policies and measure and analyze performance data through management systems, assessments, real-time monitoring, surveys and target setting

Do

We develop and execute these plans, including conservation measures, replacing existing systems and installing products with environmentally friendly alternatives

Check

We monitor the impacts of projects and actions through energy audits, commissioning, follow-up assessments and real-time monitoring

Act

The results of these steps inform our strategies on the effectiveness of our actions, influences our policies and helps us achieve our targets

UN Principles for

Responsible Investment

The Principles for Responsible Investment (PRI) is the most widely adopted sustainability integration standard that enables asset owners and managers to publicly demonstrate a commitment to responsible investment and contribute towards building a more sustainable financial system.

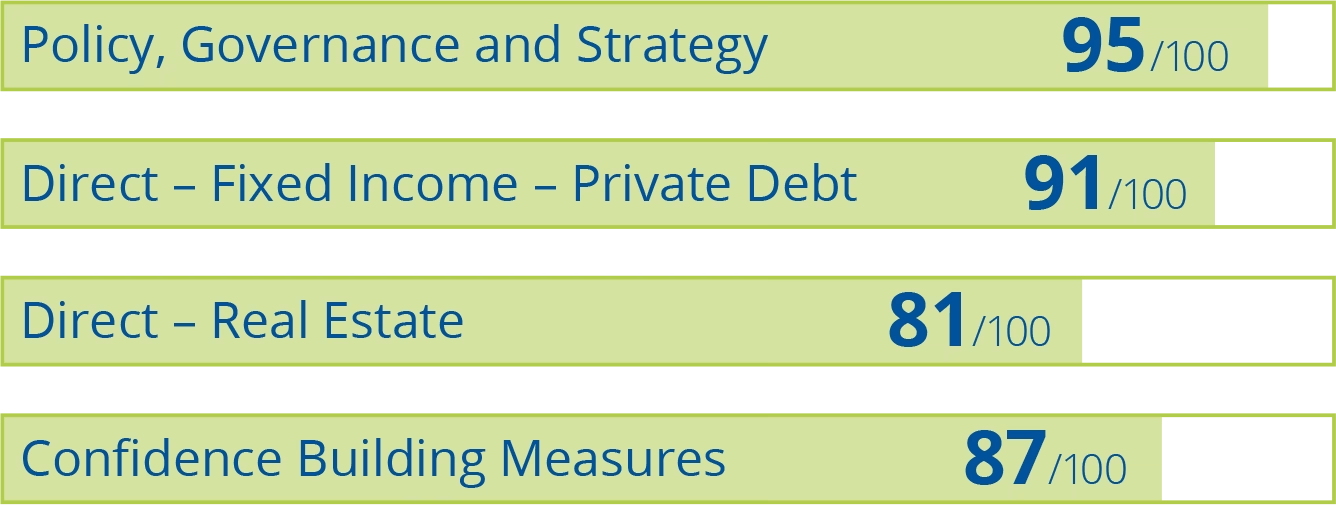

In 2024, KingSett performed very strongly across all four modules we are required to submit to exceeding the PRI Median scores in all modules. In the Direct – Fixed Income – Private Debt module, our score progressed by 49%, rising from 61 to 91. This improvement in performance reflects the expanded ESG programming that has been integrated into the mortgage business. Some of these initiatives included:

- ESG surveying of loans

- Ranking of loans under ESG criteria (low/medium/high)

- Incorporating material ESG factors across the business

- Review of ESG factors in due diligence

- Negative and positive screening

KingSett will continue to leverage the PRI standard to identify new areas of focus and create value for our stakeholders across all of our business functions.

Climate-related Disclosures

Task Force on Climate-related Financial Disclosures (TCFD)

KingSett is committed to being transparent about our climate-related risks and environmental performance. To do so, we align our disclosures with the TCFD recommendations. In December 2024, the Canadian Sustainability Disclosure Standards (CSDS) were released, which incorporate and expand upon the recommendations of the TCFD. At the time of this report, adoption of the CSDS is voluntary. Going forward, we will review these standards and consider our roadmap for adoption in a future period.

The table below outlines where you can find our climate disclosures.

| Recommendation | Website Location | |

|---|---|---|

| TCFD Governance A | Describe the board’s oversight of climate-related risks and opportunities | Governance |

| TCFD Governance B | Describe management’s role in assessing and managing climate-related risks and opportunities | Governance |

| TCFD Strategy A | Describe the climate-related risks and opportunities the organization has identified over the short, medium and long term | Climate Risk Management |

| TCFD Strategy B | Describe the impact of climate-related risks and opportunities on the organization’s businesses, strategy and financial planning | Climate Risk Management |

| TCFD Strategy C | Describe the resilience of the organization’s strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario | Climate Risk Management |

| TCFD Risk Management A | Describe the organization's processes for identifying and assessing climate-related risks | Climate Risk Management |

| TCFD Risk Management B | Describe the organization's processes for managing climate-related risks | Climate Risk Management |

| TCFD Risk Management C | Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organization's overall risk management | Risk Management |

| TCFD Metrics and Targets A | Disclose the metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process | Climate Risk Management |

| TCFD Metrics and Targets A | Disclose scope 1, 2 and if appropriate, 3 carbon emissions and the related risks | Climate Risk Management |

| TCFD Metrics and Targets C | Describe the targets used by the organization to manage climate-related risks and opportunities and performance against targets | Climate Risk Management |

SASB & Data Assurance

As part of our commitment to transparency and sustainability, KingSett provides disclosures informed by the Sustainability Accounting Standards Board (SASB) Real Estate Standard for consumptions and the Greenhouse Gas (GHG) Protocol for emissions. In addition to the below table of key performance indicators, our SASB table is included on our website which outlines key sustainability metrics relevant to our industry, including energy management, water usage, tenant engagement and climate change adaptation.

| SASB Code and Topic | Accounting Metric | Unit of Measure | Deviation from SASB | 2024 Value/Location of Info |

|---|---|---|---|---|

| Energy Management | ||||

| IF-RE-130a.1 | Energy consumption data coverage as a percentage of total floor area, by property sector | |||

| Office | Percentage (%) by floor area | None | 100% | |

| Multi-residential | Percentage (%) by floor area | None | 97% | |

| Retail | Percentage (%) by floor area | None | 100% | |

| Industrial | Percentage (%) by floor area | None | 20% | |

| IF-RE-130a.2(1) | Total energy consumed by portfolio area with data coverage, by property sector | |||

| Office | ekWh | None | 147,056,978 | |

| Multi-residential | ekWh | None | 58,981,501 | |

| Retail | ekWh | None | 26,730,902 | |

| Industrial | ekWh | None | 1,291,102 | |

| Total energy consumed, all property sectors | ekWh | Note 1 | 234,060,483 | |

| IF-RE-130a.2(2) | Percentage grid electricity, by property sector | |||

| Office | Percentage (%) | None | 44% | |

| Multi-residential | Percentage (%) | None | 33% | |

| Retail | Percentage (%) | None | 51% | |

| Industrial | Percentage (%) | None | 75% | |

| IF-RE-130a.2(3) | Percentage renewable electricity, by property sector | |||

| Office | Percentage (%) | None | 0% | |

| Multi-residential | Percentage (%) | None | 0% | |

| Retail | Percentage (%) | None | 0% | |

| Industrial | Percentage (%) | None | 0% | |

| IF-RE-130a.3 | Like-for-like percentage change in energy consumption for the portfolio area with data coverage, by property sector | |||

| Office | Percentage (%) | None | -1% | |

| Multi-residential | Percentage (%) | None | -2% | |

| Retail | Percentage (%) | None | -1% | |

| Industrial | Percentage (%) | None | 4% | |

| IF-RE-130a.4(1) | Percentage of eligible portfolio that has an energy rating, by property sector | |||

| Office | Percentage (%) by floor area | None | 84% | |

| Multi-residential | Percentage (%) by floor area | None | 33% | |

| Retail | Percentage (%) by floor area | None | 0% | |

| Industrial | Percentage (%) by floor area | None | 0% | |

| IF-RE-130a.4(2) | Percentage of eligible portfolio that is certified to ENERGY STAR, by property sector | |||

| Office | Percentage (%) by floor area | None | 74% | |

| Multi-residential | Percentage (%) by floor area | None | 0% | |

| Retail | Percentage (%) by floor area | None | 0% | |

| Industrial | Percentage (%) by floor area | None | 0% | |

| IF-RE-130a.5 | Description of how building energy management considerations are integrated into property investment analysis and operational strategy | |||

| None | See Decarbonization | |||

| Water Management | ||||

| IF-RE-140a.1(1) | Water withdrawal data coverage as a percentage of total floor area, by property sector | |||

| Office | Percentage (%) by floor area | None | 100% | |

| Multi-residential | Percentage (%) by floor area | None | 97% | |

| Retail | Percentage (%) by floor area | None | 100% | |

| Industrial | Percentage (%) by floor area | None | 18% | |

| IF-RE-140a.1(2) | Water withdrawal data coverage as a percentage of floor area in regions with High or Extremely High Baseline Water Stress, by property sector | |||

| Office | Percentage (%) by floor area | None | Not Tracked | |

| Multi-residential | Percentage (%) by floor area | None | Not Tracked | |

| Retail | Percentage (%) by floor area | None | Not Tracked | |

| Industrial | Percentage (%) by floor area | None | Not Tracked | |

| IF-RE-140a.2(1) | Total water withdrawn by portfolio area with data coverage, by property sector | |||

| Office | Cubic metres (m3) | None | 374,590 | |

| Multi-residential | Cubic metres (m3) | None | 507,966 | |

| Retail | Cubic metres (m3) | None | 121,310 | |

| Industrial | Cubic metres (m3) | None | 5,188 | |

| Total water withdrawn, all property sectors | Cubic metres (m3) | Note 2 | 1,009,054 | |

| IF-RE-140a.2(2) | Percentage of total water withdrawn in regions with High or Extremely High Baseline Water Stress, by property sector | |||

| Office | Percentage (%) | Not Tracked | ||

| Multi-residential | Percentage (%) | Not Tracked | ||

| Retail | Percentage (%) | Not Tracked | ||

| Industrial | Percentage (%) | Not Tracked | ||

| IF-RE-140a.3 | Like-for-like percentage change in water withdrawn for portfolio area with data coverage, by property sector | |||

| Office | Percentage (%) | None | 5% | |

| Multi-residential | Percentage (%) | None | -1% | |

| Retail | Percentage (%) | None | 2% | |

| Industrial | Percentage (%) | None | -42% | |

| IF-RE-140a.4 | Description of water management risks and discussion of strategies and practices to mitigate those risks | |||

| None | See Climate Risk Management | |||

| Management of Tenant Sustainability Impacts | ||||

| IF-RE-410a.1(1) | Percentage of new leases that contain a cost recovery clause for resource efficiency-related capital improvements, by property sector | |||

| Office | Percentage (%) by floor area | None | 100% | |

| Multi-residential | Percentage (%) by floor area | None | 0% | |

| Retail | Percentage (%) by floor area | None | 100% | |

| Industrial | Percentage (%) by floor area | None | 100% | |

| IF-RE-410a.1(2) | Associated leased floor area to leases that contain a cost recovery clause for resource efficiency-related capital improvements, by property sector | |||

| Office | Leasable Floor Area (sqft) | None | 6,762,560 | |

| Multi-residential | Leasable Floor Area (sqft) | None | - | |

| Retail | Leasable Floor Area (sqft) | None | 2,192,450 | |

| Industrial | Leasable Floor Area (sqft) | None | 1,402,822 | |

| IF-RE-410a.2 | Percentage of tenants that are separately metered or submetered for (1) grid electricity consumption and (2) water withdrawals, by property sector | |||

| Office | Percentage (%) by floor area | None | Not Tracked | |

| Multi-residential | Percentage (%) by floor area | None | Not Tracked | |

| Retail | Percentage (%) by floor area | None | Not Tracked | |

| Industrial | Percentage (%) by floor area | None | Not Tracked | |

| IF-RE-410a.3 | Discussion of approach to measuring, incentivizing and improving sustainability impacts of tenants | |||

| None | See Tenant Engagement and Well-being | |||

| Climate Change Adaptation | ||||

| IF-RE-450a.1 | Area of properties located in 100-year flood zones, by property sector | |||

| Office | Leasable Floor Area (sqft) | None | Not Tracked | |

| Multi-residential | Leasable Floor Area (sqft) | None | Not Tracked | |

| Retail | Leasable Floor Area (sqft) | None | Not Tracked | |

| Industrial | Leasable Floor Area (sqft) | None | Not Tracked | |

| IF-RE-450a.2 | Description of climate change risk exposure analysis, degree of systematic portfolio exposure, and strategies for mitigating risks | |||

| None | See Climate Risk Management | |||

| Activity Metrics | ||||

| IF-RE-000.A | Number of assets, by property sector | |||

| Office | Number | None | 17 | |

| Multi-residential | Number | None | 31 | |

| Retail | Number | None | 4 | |

| Industrial | Number | None | 22 | |

| IF-RE-000.B | Leasable floor area, by property sector | |||

| Office | Leasable Floor Area (sqft) | None | 6,762,560 | |

| Multi-residential | Leasable Floor Area (sqft) | None | 3,349,298 | |

| Retail | Leasable Floor Area (sqft) | None | 2,192,450 | |

| Industrial | Leasable Floor Area (sqft) | None | 1,402,822 | |

| IF-RE-000.C | Percentage of indirectly managed assets, by property sector | |||

| Office | Percentage (%) | None | 0% | |

| Multi-residential | Percentage (%) | None | 0% | |

| Retail | Percentage (%) | None | 0% | |

| Industrial | Percentage (%) | None | 0% | |

| IF-RE-000.D | Average occupancy rate, by property sector | |||

| Office | Percentage (%) | None | 83% | |

| Multi-residential | Percentage (%) | None | 94% | |

| Retail | Percentage (%) | None | 96% | |

| Industrial | Percentage (%) | None | 98% | |

Data Assurance and Opinion

KingSett has obtained independent limited assurance for select performance metrics in accordance with the requirements of Canadian Standard on Assurance Engagements (CSAE) 3000, Attestation Engagements Other Than Audits or Reviews of Historical Financial Information and Canadian Standard on Assurance Engagements (CSAE) 3410, Assurance Engagements on Greenhouse Gas Statements. Please visit the following link for KingSett’s limited assurance report.

| Key performance indicators Criteria-Emissions | Criteria | 2019 | 2023 | 2024 |

|---|---|---|---|---|

| GHG Emissions Scope 1 (tCO2e) 1,3,4,5 % change restated from prior year 2 |

Quantification methodology for Scope 1 and Scope 2 emissions is aligned with The GHG Protocol: A Corporate Accounting and Reporting Standard. Management's internally developed criteria: To use emission factors and global warming potentials from the 2024 published National Inventory Report 1990-2022. | 21,928 -9% |

16,117 -12% |

15,837 ✓ |

| GHG Emissions Scope 2, location based (tCO2e) 1,3,4,5 % change restated from prior year 2 |

15,604 -9% |

12,745 -9% |

12,650 ✓ | |

| GHG Emissions Scope 1 and Scope 2, location based (tCO2e) 1,3,4,5 % change restated from prior year 2 |

37.532 -9% |

28,862 -9% |

28,488 ✓ | |

| GHG Emissions Scope 3 (tCO2e) -Category 13 - Tenant Electricity3,4,5 % change restated from prior year 2 |

Quantification methodology for Scope 3 category 13 emissions is aligned with The GHG Protocol: A Corporate Accounting and Reporting Standard. Management’s internally developed criteria: To include only electricity related emissions and use emission factors and global warming potentials from the 2024 published National Inventory Report 1990-2022. | 1,367 -1% |

1,893 20% |

1,666 ✓ |

| GHG Emissions Scope 3 (tCO2e)-Category 1 - Water-pump Emissions 3,4,5 % change restated from prior year 2 |

Quantification methodology for Scope 3 category 1 emissions is aligned with The GHG Protocol: A Corporate Accounting and Reporting Standard. Management's internally developed criteria: To include emissions related only to the purchase of water and use emission factors and global warming potentials from the 2024 published National Inventory Report 1990-2022. | 100 -7% |

89 0% |

91 ✓ |

| Key performance indicators Criteria-Consumptions | Criteria | 2023 | 2024 | 2024 Data Coverage |

|---|---|---|---|---|

| Total water consumed (m3) 3 % change restated from prior year 2 |

SASB IF-RE-140a.2 (1) Management's internally developed criteria: to include only total amount and not by portfolio level |

996,587 -1% |

1,009,054 ✓ | 91% |

| Total energy consumed within the organisation (ekWh) 3 % change restated from prior year 2 |

SASB IF-RE-130a.2 (1) Management's internally developed criteria: to include only total amount and not by portfolio level |

236,778,405 -7% |

234,060,483 ✓ | 91% |

✓ Metric assured by PwC

1 All carbon emissions calculation methodologies are based on The Greenhouse Gas Protocol — A Corporate Accounting and Reporting Standard, using the operational control approach.

2 Previously reported 2019 and 2023 figures have been restated from previously published figures in KingSett’s 2023 GRI Index. KingSett recalculates and restates all historical years for its energy, carbon emissions, water and waste annually. This is done to capture improvements in data coverage/actual data, emission factor updates, acquisitions/dispositions3. All CREIF properties under KingSett’s management as of December 31, 2024, have been included in all calculations. Assets sold throughout the year are included up to the date of disposition.

3 All CREIF properties under KingSett’s management as of December 31, 2024, have been included in all calculations. Assets sold throughout the year are included up to the date of disposition.

4 Greenhouse gases included in the calculation of the Scope 1, 2 and limited Scope 3 emissions include CO2, CH4 and N2O.

5 Carbon emissions factors and underlying global warming potentials are taken from Environment Canada’s 2024 National Inventory Report, Enwave’s 2023 Study Report (specifically for steam and chilled water published in 2024) and the 2009 Maas Report (specifically for water-pump emissions).